Hurst title loans provide swift financial solutions for local drivers using their vehicle's title as collateral. Ideal for urgent needs and individuals with poor credit, these loans offer same-day access, flexible eligibility, and a straightforward application process via an online form. Different vehicles can be used as collateral, catering to cars, trucks, and even boats.

Local drivers looking for quick and accessible funding solutions often turn to Hurst title loans. This guide aims to demystify how these loans work, offering a clear understanding for those considering this option. We’ll explore who qualifies, the application process, and provide insights into the benefits of Hurst title loans. By the end, you’ll know exactly what to expect when securing your loan, empowering you to make informed financial decisions tailored to your needs.

- Understanding Hurst Title Loans: A Local Driver's Guide

- Eligibility Criteria: Who Qualifies for Hurst Title Loans?

- The Process: How to Secure a Hurst Title Loan Effortlessly

Understanding Hurst Title Loans: A Local Driver's Guide

Hurst Title Loans are a financial solution designed to support local drivers who need quick access to cash. Unlike traditional loans that often come with stringent requirements and lengthy approval processes, Hurst Title Loans offer a simpler approach. Here’s how it works: you use your vehicle’s title as collateral to secure the loan. This means your car remains in your possession while you gain access to immediate funds. The process is straightforward, focusing on your vehicle’s value rather than complex credit checks or extensive documentation.

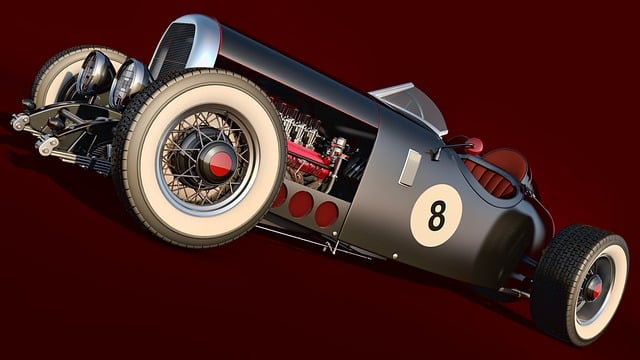

Once you apply for a Hurst Title Loan, lenders will assess your vehicle’s condition and current market value. If approved, you can receive the loan amount relatively quickly, often within the same day. It’s ideal for local drivers in urgent need of funds, whether it’s for unexpected expenses or an exciting purchase like boat title loans. Remember, while Hurst Title Loans provide a convenient option, understanding the loan requirements and conditions is crucial to ensuring a positive borrowing experience.

Eligibility Criteria: Who Qualifies for Hurst Title Loans?

Hurst title loans are designed to provide financial assistance to local drivers who need a quick and convenient loan solution. To qualify for these loans, borrowers must meet certain eligibility criteria. Firstly, they should be legal residents of Hurst or nearby areas, ensuring that the lender can easily verify their identity and residency status. Additionally, applicants must own a vehicle with a clear title, meaning there are no outstanding liens or existing loans on the car. This ownership requirement serves as collateral for the loan, making it an attractive option for those seeking financial relief without the hassle of traditional bank applications.

Loan eligibility also extends to individuals who may have poor credit scores or a history of bad credit. While a good credit standing can often expedite the approval process, Hurst title loans prioritize the borrower’s ability to repay the loan rather than their credit history. As long as they can demonstrate a stable source of income and meet the basic eligibility requirements, drivers can access much-needed financial solutions through these title loans.

The Process: How to Secure a Hurst Title Loan Effortlessly

Securing a Hurst Title Loan is a straightforward process designed to help local drivers meet their financial needs quickly and efficiently. It starts with an applicant providing their vehicle’s title as collateral. This can be for a variety of vehicles, including cars, trucks, or even boats—a service that sets Hurst apart from traditional lenders who may only offer Fort Worth loans limited to cars. Once the title is submitted, a professional assessment determines the loan amount based on the value of the vehicle.

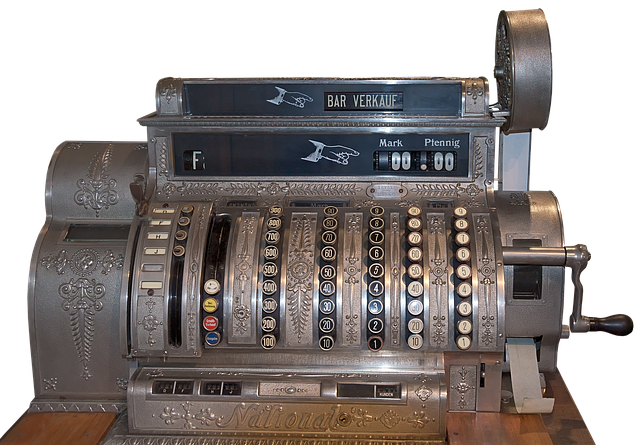

The application process is entirely online, making it accessible and convenient. Applicants can apply from the comfort of their homes, filling out a simple form with personal and vehicle information. After submission, a representative will review the details and get in touch to discuss terms and conditions. This entire procedure can be completed within a few short steps, offering local drivers an excellent alternative financing option when they need it most.

Hurst title loans offer a unique and accessible solution for local drivers in need of quick cash. By leveraging the equity in their vehicles, these loans provide an alternative financing option with simpler eligibility requirements compared to traditional bank loans. The streamlined process ensures that qualified individuals can secure funds efficiently, making Hurst title loans a practical choice for those seeking immediate financial support.